Table of Contents

More Glossary Articles

Recurring revenue is the lifeblood of any SaaS. It’s what makes building a SaaS business so appealing. You don’t have to worry about one-off sales that may or may not return.

If you’ve got a solid product, they automatically return every single month- amazing!

In general, it’s a straightforward SaaS metric, but depending on your business model (including usage-based pricing, hybrid billing, and AI-powered features), you'll want to consider some nuances to better understand its impact on your revenue.

Key Takeaways

- Monthly recurring revenue (MRR) helps you track recurring revenue, and is commonly used to track performance in SaaS and subscription companies.

- There are multiple types of MRR to track, including churned and net new MRR, which can help businesses understand what’s driving revenue changes.

- Knowing how to analyze and improve MRR can be crucial to long-term business success, and can be impacted by pricing strategies, the customer experience, and active churn prevention efforts.

- While you should take care to calculate MRR accurately and it can be used to assess financial decisions, it should not be used as a set accounting figure.

- Leveraging revenue analytics software can help you track multiple MRR metrics to improve your financial decision-making.

Tired of spending countless hours on spreadsheets to calculate your MRR? Get a free trial of Baremetrics.

What is MRR?

Monthly Recurring Revenue, commonly abbreviated as “MRR” is all of your recurring revenue normalized into a monthly amount. It’s a metric commonly used among subscription and SaaS companies.

It’s a way to average your various pricing plans and billing periods into a single, consistent number that you can track the trend of over time.

Think of MRR as your business's financial heartbeat—it standardizes your various pricing plans, billing periods, and customer segments into a single, trackable number that reveals your growth trajectory over time.

How to Calculate MRR

The MRR calculation is pretty simple. You need to multiply your average revenue per account by the total number of customers for that month.

MRR = number of customers * average billed amount

So, 10 customers paying you an average of $100 monthly would mean an MRR of $1,000.

10 customers & $100/mo = $1,000 MRR

How to calculate net new MRR

As your subscription business grows, it will become important to track not only your top-level MRR but also the factors that explain the change in your MRR over previous months.

If you added $1,000 in new MRR, you’d want to know where that came from, right?

Lucky for you, that also is relatively easy using three elements that make up what we’ll call “Net New MRR”.

- New MRR – Additional MRR from new customers

- Expansion MRR – Additional MRR from existing customers (also known as an “upgrade”)

- Churned MRR – MRR lost from cancellations or downgrades

Here’s the calculation for the net new MRR:

Net New MRR = New MRR + Expansion MRR – Churned MRR

If you churn more MRR than you get from New or Expansion MRR, you end up losing MRR that month…which would make you sad.

Very, very sad.

Also, if you’re reporting on MRR to higher-ups, investors, or your team, breaking down your net new MRR can provide a lot of extra context for the numbers.

How to analyze MRR

While MRR seems like a straightforward metric, it’s actually very nuanced and can give you a crucial picture of how your subscription business is growing (or not).

Analyzing MRR goes beyond simple tracking—it's about understanding customer behavior patterns, predicting future growth, and identifying optimization opportunities before they become problems.

But how do you get to that nuanced data and reporting? What should you look for? What points to potential trouble? And how do you grow MRR so you can, in turn, grow your startup? Let’s take a look!

Many of these tips use features built directly into Baremetrics, easily surfacing the insights covered here. But the data points themselves are likely accessible to you no matter what reporting software you use…it just may take quite a bit more digging.

How does MRR differ from accounting revenue?

When tracking revenue, it’s important to understand exactly which terms to use and what they mean. A crucial example of this is when looking at accounting revenue vs. MRR.

Monthly recurring revenue, for example, looks specifically at revenue you’ll expect to see month-over-month. Accounting revenue, however, adheres to a standardized set of rules that ensure companies report their earnings consistently and transparently when providing a comprehensive financial overview.

Learn more about the difference between MRR vs. accounting revenue.

Types of MRR

tracking MRR types has become even more critical as customer acquisition costs continue to rise. mentioned earlier in the guide, there are five types of MRR:

- New MRR – MRR from new customers

- Expansion MRR- MRR from existing customers (upgrades)

- Reactivation MRR – MRR from previous customers

- Contraction MRR – Lost MRR from existing customers (downgrades)

- Churned MRR – Lost MRR from canceled customers

Knowing those types is important because it gives you direct insight into the “why.” You can see exactly why your MRR went up or down in a given month.

Seeing the “why” in chart form is very helpful.

There’s a lot of information here, but the MRR is much easier to understand if we scroll down to see it in more detail.

If you want to dig even deeper, Baremetrics gives you a graph of your monthly growth, which shows your net gains and losses in MRR each month with exact numbers.

Here’s what all those bars, colors, words, and numbers translate to (looking at October)…

- We had New MRR (new customers) of $4,140, which was an 80% increase over the previous month.

- We had Expansion MRR (upgrades) of $2,619, which is down 20% from the previous month.

- We had Reactivations MRR (previous customers who came back) of $473, which is up 6.5% from the previous month.

- We had Contraction MRR (downgrades) of $158, which is a 40% improvement from the previous month.

- We had Churned MRR (cancellations) of $4,622, which is a pretty steep 20% decline.

- Adding all these MRR types together resulted in a net increase of MRR to the tune of $2,452.

Now, the observations we can make!

- Our churn and contraction MRR outpaced our expansion MRR. That means more of our existing customers canceled or downgraded than upgraded, which is a negative trend compared to the previous few months.

- Had we not broken down this MRR by type, all we’d see is “Yay! $2,620 in growth!” We’d miss out on the fact that we churned over $4,500 in revenue…which is something that needs to be worked on.

- Our new MRR jumped significantly and was actually our highest of the year. Since our expansion MRR was lower than normal, our revenue from new customers helped us cover the losses from churn and contraction.

If you aren’t breaking out your MRR by type, you’re really missing out on some crucial data points. There are so many knobs to twiddle when building a business, and the more you actually know what each knob is doing, the more efficient you’ll be.

Plans as a Percentage of Total MRR

Knowing what percentage of your total MRR your plans make up is very important.

For example, what if you have 90% of your customers on a plan that only makes up 10% of your MRR? That balance you shouldn’t force to work because the support load wouldn’t cover itself.

A table is great for visualizing this.

These are our top plans based on MRR. From this, we can make a couple of interesting observations.

- Most of our MRR comes from our mid-tier pricing plans. Nearly half (49%) of our customers pay us $250/month or less, so we don’t get 90% of our revenue from 10% of our customers, which is great. That means our MRR doesn’t get completely wrecked if one or two large accounts cancel.

- 19% of our customers are on our lowest tier plan ($50/month), but that only accounts for 6% of our MRR. Increasing the cost of that lowest tier by just $25 could significantly boost our MRR.

Know where your revenue comes from and focus your efforts on the plans with a higher yield.

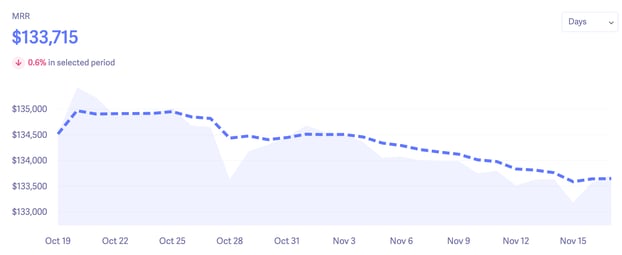

Trends

Looking at large quantities of data can sometimes be misleading. Seeing a big drop on a single day can sound alarms, but the important thing is not one-off events. What really deserves your attention are the trends over time.

Reacting to singular events is a recipe for disaster as there are an infinite number of anomalies that can occur that you can ignore.

I find looking at data on a level more granular than monthly is mostly futile.

You definitely want to be careful when making major decisions on granular data. A monthly basis is about as small as you want when using the data for company-direction type of business decisions.

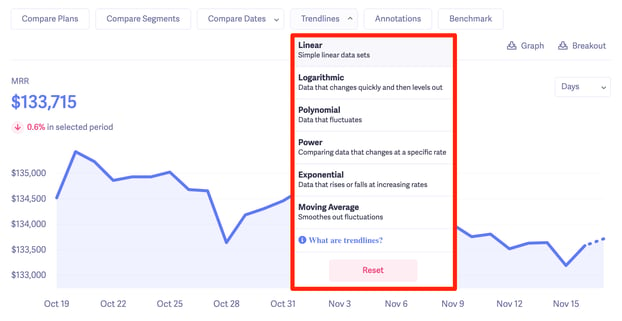

Using trend lines is a great way to tame some of the anomalies and better understand the averages and the general direction things are heading, rather than getting distracted by blips on the radar.

Here’s a Moving Average trend line that smooths out the hills and valleys from a few months of data.

There are a number of different types of trend lines built right into Baremetrics.

- Linear trend lines – Linear trend lines draw a straight line through your data and completely ignore peaks and valleys. If you’re looking at a metric that is mostly up-and-to-the-right (such as MRR, hopefully), linear is a great choice.

- Logarithmic trend lines – Similar to linear, except it will follow a curve. Great for data that changes rapidly and then settles, like a rapidly growing MRR that plateaus or slows.

- Polynomial trend lines – Another one with lots of syllables! This trendline is great for following data with lots of peaks and valleys. Polynomial trendlines may have a maximum of 2 curves. Churn and LTV are two metrics that Polynomial trendlines can work well with.

- Power trend lines – These trendlines change at a specific rate. This works well with any up-and-the-right type data, like, say, MRR.

- Exponential trend lines – These are for data that rises or falls exponentially. Only a handful of subscription businesses grow exponentially –a great example is a company like Slack.

- Moving Average trend lines – For each data point, we look at it and the two other data points next to it and average them. This is great for data that ebbs and flows regularly and often has erratic data points. Churn, LTV, and ARPU often work well with this method.

Track different trends and stay current with real-time metrics with a free trial of Baremetrics.

How to Grow MRR

As wonderful as recurring revenue is, it can also be the most downright frustrating and eye gouging part of your business. Gail Goodman, CEO of Constant Contact calls this the “long, slow, SaaS ramp of death”, and for good reason.

You can put in months of hard work improving every last nook, pixel, and cranny or put together the greatest marketing campaign your team can muster, all to budge your MRR graph barely. Heck, in some cases, you may actually see a decline in your recurring revenue.

It’s maddening.

So while there are certainly stories you’ll read on Hacker News or Reddit or Twitter about someone with hockey stick growth, the fact is…99% of subscription businesses won’t see that.

Instead, what they’ll see is slow, painfully incremental, boring growth.

But it’s not all doom ‘n gloom! There are, in fact, things you can do to increase it. Things you can start putting in to practice today!

Let’s take a look at four things you can get the ball rolling on how to improve MRR.

1. Charge more

I know, I know. Charging more sounds obvious, but the fact is that most companies are drastically underpricing their product.

The most common cause of charging too little is that we, as founders, are self-conscious. We’re afraid of rejection, and we don’t give ourselves enough credit for the problems our companies solve.

So, we charge too little to reduce the chance someone will reject us.

The fact is, if you’re solving any real, tangible problems for your customers, you shouldn’t be charging single-digit amounts. Whenever I see some business software charging $5 monthly, I want to scream at them. It’s insanity.

Businesses use software for at least one of three things:

- To save time

- To save money

- To make more money

These are all summed up as “value”…businesses pay for “value”.

If your product is only creating $5 of value, then I suggest you find a new product.

That’s harsh, but I’d also suggest that your product likely creates a lot more value than $5.

Let’s do some quick math here as a simple example.

How much is your customer’s time worth? I’d bet at least $50/hour. Depending on their role, it could be hundreds of thousands of dollars an hour, but let’s start on the low end.

If you save them over 6 minutes of time a month, then you’re already underpriced at $5/mo. But I bet you aim to have people spend more than 6 minutes of time a month with your software.

There’s just no scenario where you shouldn’t charge at least $20 a month for your product. And in reality, most companies will happily pay many multiples of that.

But if you’re weary of this, just run a little test.

Double prices. Just double them. Don’t change anything else. Don’t rearrange features or raise limits on anything. Just double the prices on your pricing page. And wait.

Then, in a month, check if your conversion rates or growth rates declined. My guess is that neither will decline…in fact I’d bet both will actually increase!

Now, do it again. And again. And again. Do it every month until you find it’s not having a positive effect on your revenue growth or customer lifetime value!

2. Upsells

Who are you more likely to trust with your business? Someone you’ve had zero experience or interaction with? Or someone you converse with and interact with on a daily basis?

The latter, obviously.

And that’s why it’s much cheaper to grow revenue from your existing customer base than acquire new customers. It’s not that you don’t need both, but acquiring new customers is just always more expensive.

If your customers are growing and getting more value from your business over time, then you should match that with pricing.

You aren’t running a charity; you’re running a business, and if customers are getting more value, then that’s the perfect opportunity for you to offer an upgrade.

The value you provide should always be greater than the price they’re paying, but they should grow somewhat in parallel.

There are all sorts of ways, logistically, to set this up. You can get really creative with this stuff, but let’s discuss a few common ways to increase your MRR with different pricing models.

Per-user pricing

Per-user or per-seat pricing is one common way to attach value provided to the value received. This type of pricing essentially means there’s no limit to how much you could make from a given business.

As your customer grows and more of their team uses your product, you make more.

If you want to get really wild, you can combine per-user pricing and tiered pricing like Slack. When customers upgrade, their revenue per user automatically increases.

Some companies you’ve probably heard of that use this type of pricing/upgrade model:

- Salesforce – Pricing is anywhere from $25/month per user up to $300/month per user.

- Atlassian – They’ve got a whole suite of various products, but pricing is all based on the number of users.

- Trello – Pricing starts around $10/month per user

- Slack – Pricing starts at around $6/month per user and goes up based on the needed features.

Usage-based pricing

You’re probably most familiar with metered or usage-based pricing from hosting/infrastructure companies like Heroku or Amazon Web Services.

The more you use their services, the more you pay. There’s a very literal correlation to the exchange of value.

Add-on pricing

You likely have some base plans that you already offer, but deciding ahead of time exactly how you “bucket” features within those plans can be a little bit of a shot in the dark that you aren’t ever sure you have right.

If you position your biggest features as “add-ons,” your customers will easily create the perfect package of tools.

It’s also a much easier upsell (i.e., “For just $10 more per month, you can get Feature X”).

3. Get rid of your free plan

Freemium is a default for nearly any software company. It seems silly to suggest not having a free plan, but that’s exactly what I’m suggesting.

Get rid of your free plan; you’re giving away the farm.

I know, I know. It’s not that easy. So, let’s break it down a bit.

What’s the purpose of a free plan at all? Well, generally, it’s used for one of two things.

“Free” is a marketing tool

The thinking goes that by offering something free, you can get exponentially more people in the door, giving you the opportunity to sell them on a premium plan.

But the problem is that it anchors the “value” conversation to $0. Anything you say, do, or offer will be viewed through the lens of “I’m currently spending exactly $0…why would I spend a not-$0 amount?” This sets your user base up to categorically not value your product.

Arguably, “free” as a marketing tool can be great for consumer businesses, as consumers are traditionally extremely price-conscious and have a nearly infinite number of options. Their motivations for spending money are usually much different as well (most things consumers buy are “wants,” not “needs”).

But there are few business scenarios where a blatantly “free” plan is beneficial. The economies of scale just don’t work in your favor. You need a huge “top of the funnel” to make the conversion rates pan out profitably in the long term.

On top of that, it’s very expensive to support all of those free users. Large, venture-backed companies with 10’s or 100’s of millions in the bank can afford to support a large free user base. You cannot.

“Free” as a way to trial the software

Many companies use a “free” plan to let potential customers try out the software. The company benefits from the “marketing tool” angle, and users get to see what type of value they could get! Two birds, one stone, right?!?! Wrong.

Not only do you have the downsides of the “free as a marketing tool” angle, but you’re also offering your customers a limited view of what you can do for them.

That means the customer is told, “This has very little value and also can’t even do that much for me.”

So what’s the solution here?

Instead of offering a free plan, offer a time-limited free trial like Mangools, for example.

It could be 7 days, 14 days, 30 days, 60 days…doesn’t really matter how long other than they need enough time to be able to understand just how much value they’ll get from your service.

4. Remove a “maximum” price/unlimited

Look, I get it. Pricing SaaS products is hard.

It’s one of the most difficult decisions you’ll make when creating any type of product, as there’s no “easy” or “right” answer to “How much should I charge for my product?”

But there is one bit of advice that I strongly urge you to consider: never offer an “unlimited” plan.

Early on in my career, I made this mistake. I had never built a business on recurring revenue before, so coming up with a good pricing model was like pulling numbers out of thin air.

After devising what I thought was a great set of plans, I decided to shoot for the proverbial stars and offer an “unlimited” plan for a whopping $99. Ha!

When you’re new to pricing, it’s easy to think, “If I can get anyone to pay me $99 a month, I’ll be set!”

You’re itching to make some money, any money, and you’ll give away the farm to try to entice people to fork it over.

But stop. Stop giving it away. Chances are you’re already charging far too little, and having an “unlimited” plan just puts the nail in the coffin. Here’s why.

As we talked before, when you’re pricing anything, you should be pricing based on value. You need to find a balance of where what they’re paying is comparable to the value you’re providing, and the more value you provide, the more money you should make.

With that in mind, does “unlimited” make sense? No. Because they get “unlimited” value while you just capped how much income you can make on any given customer. Now would be an appropriate time to facepalm.

Do you realize how bad of a move that is?

The type of customers who will make use of that “unlimited” plan are exactly the customers who will be more than happy to pay you exponentially more than you’re charging!

They’re the ones who stand to get the most value, and the more they use your product, the more value they get! Charge them accordingly.

MRR Calculation Mistakes

MRR, while theoretically a simple metric to calculate, does have some intricacies and edge cases that can trip entrepreneurs up a bit.

There are six mistakes for calculating MRR businesses commonly make. Here’s a quick overview of common mistakes to avoid:

1. Incorrectly accounting for non-monthly billing intervals

MRR is, by definition, a “monthly” figure. But “monthly” isn’t the only way to bill a customer. The most common additional billing interval is annual, but quarterly and weekly billing are also common.

So, how do you properly include those non-monthly intervals into a monthly recurring revenue figure? You normalize it.

For example, if you bill someone $1,200 annually, you simply divide that number by 12, meaning that the $1,200/year customer shows up as $100/mo in your MRR figure.

What about weekly? Well, there are 52 weeks in a year, so you’d divide 52 by 12, which gives you 4.33 as a multiplier. So, if you billed $10 per week, you’d say $10 * 4.33 for $43.30 in MRR.

2. Including non-recurring revenue

Monthly Recurring Revenue is meant to measure your company's growth and future health.

If you start including things like one-time setup fees or even monthly installments (“3 easy payments of $19.99”), you’re artificially inflating your MRR figure and generally setting yourself up for a bit of a letdown.

If a payment doesn’t automatically recur in perpetuity until a customer decides to stop the service, then it shouldn’t be included in your MRR figure.

3. Treating MRR as an accounting figure

MRR is, in no scenario, a figure that should be used for accounting or tax purposes. It’s a business insights figure, not an accounting figure.

When you want to start talking accounting terms and figures, you’ll be interested in Bookings, Billings and Deferred Revenue. But MRR is not a number you’ll be using with your accountant.

Monthly Recurring Revenue is meant to track growth trends and give you insights into where revenue growth comes from. You can read more in depth about this here.

4. Including leads and trials

“Oh, cool, someone just started a trial on a $500/mo plan! Let’s throw them in our MRR figure!”

Nope! Don’t do that.

Yes, a certain percentage of trials and leads will convert and become part of your MRR. And yes, your conversion rate may very well be extremely consistent and reliable, but you’re talking about a different metric.

You aren’t helping anyone by artificially inflating your MRR figure with customers who might start paying you.

5. Ignoring MRR components

As we mentioned earlier, your MRR is made up of many different factors!

- New MRR

- Expansion MRR

- Reactivation MRR

- Contraction MRR

- Churned MRR

Each type of MRR tells a story and gives you insights into the “why.” If you’re only looking at the top-level MRR figure, you could very well be missing huge red flags, such as high churn that is currently masked by high growth (but definitely won’t be forever).

6. Ignoring coupons & discounts

Let’s have a quick heart-to-heart. Do you really think you should include the full value of a $250/mo customer if you’re giving them a 50% off coupon? No, you should not.

Maybe that coupon is just temporary (i.e. 50% off for 3 months), or maybe it’s a permanent discount.

The fact is, reducing the value and revenue from that customer is a real and tangible way that you really need to consider when calculating MRR. Otherwise, you’re artificially inflating your MRR figure.

Yes, this makes calculating MRR more complicated and harder to do, which is why using a tool like Baremetrics (which automatically takes all of these types of edge cases and scenarios into account) quickly becomes a no-brainer.

Track and Analyze MRR

Metrics, in and of themselves, aren’t all that useful. They’re just numbers. A given number on a given day holds little value. Real value and insight usually lie in how a given number changes over time.

Don’t get caught up in the day-to-day blips. Instead, focus on historical trends so you can make future predictions.

Calculate & Track MRR With Revenue Analytics Software

You can take the time to manually calculate your MRR as you see fit. You can do this for new MRR, churned MRR, MRR growth rate, and more. But in most cases, you probably don’t want to.

Financial and revenue analytics software can help, automating calculations so you just have to review the data when making business decisions instead of trying to calculate it. Baremetrics is a SaaS and subscription analytics platform that includes 26 key metrics, including all critical MRR data. We’ll help you get an accurate and up-to-date look at your revenue performance in real-time.

Monthly Recurring Revenue FAQ

Still, have questions about MRR? Here are some common questions we’ve seen about monthly recurring revenue and our answers:

What does MRR stand for?

MRR stands for monthly recurring revenue.

What is an MRR quota?

An MRR quota is a set MRR goal that sales teams are typically required to close in a set period of time.

An MRR quota aims to improve the sales team’s performance. If the team meets its quota, it will receive a bonus or other incentives.

How big does your MRR need to be before getting purchased?

It depends. MRR is one of several factors companies consider when acquiring a SaaS company. Some companies get acquired pre-revenue (meaning their MRR is zero), while others get acquired with millions in MRR. Baremetrics was acquired when our MRR was $134K.

Why is monthly recurring revenue important for our business?

MRR is the lifeblood of any subscription-based business.

It tells you exactly how much income you generate each month, which makes it easier to plan for the future. You always have a general idea of how much income you’ll have in the coming months.

Tracking MRR also allows you to track your growth over time. As your monthly revenue increases or decreases, you can understand how well things are going. Plus, the rate that your MRR is growing (MRR growth rate) says a lot about the overall health of your business.

It’s also essential to track your MRR growth rate vs Net MRR growth rate to gain a clear understanding into your actual recurring revenue and how factors like upgrades, expansions, and cancellations impact your bottom line.

Most SaaS companies strive for steady momentum, but the reality is you’ll probably have periods of slow, or even flat growth, with some declines every now and then.

When you track your MRR, you’ll start to build historical data and notice trends like seasonality.

How to project monthly recurring revenue

You can manually project your MRR by analyzing your average revenue growth rate and revenue churn and plugging them into a formula.

However, the easiest way to project MRR is with a forecasting tool. You can forecast MRR directly in Baremetrics (you can also calculate things like cash flow and customers).

The beauty of subscription businesses is that their revenue is more predictable than that of retail or other industries. Take advantage of this by using forecasting to see into the future!

How to set monthly recurring revenue goals

You should set MRR goals based on your MRR forecast. It’s good to have both a standard goal and a stretch goal. Your regular goal can be based on linear growth.

For instance, in the graph below, we might set an MRR goal for January of $137,797.

For our stretch goal, we’d toggle the switch to Exponential growth instead of linear, which would make our goal $179,715.

Notice that this goal is based on projected 20% revenue growth. You can play around with the revenue growth and churn rate in the forecasting tool to make your MRR more attainable.

What is committed monthly recurring revenue?

Committed monthly recurring revenue (CMRR) is a key metric for subscription businesses that combines recognized monthly recurring revenue with new bookings churn and contraction, and fees. It excludes one-off monthly fees.

You can learn more about committed monthly recurring revenue here.

How do I include annual contracts in MRR?

Yes, annual contracts should be included in your MRR. However, you shouldn’t add the entire lump sum to your MRR calculation. It needs to be divided by how many months the subscription is for.

For instance, if you get an annual contract of $12,000 (even if they paid it all upfront), $1,000 would be counted towards your MRR over the next 12 months unless they cancel.

Should I include one-time fees in MRR?

No, one-time fees like setup costs, implementation fees, or professional services should never be included in MRR. Track these separately as "non-recurring revenue" to maintain MRR integrity.