Table of Contents

.png)

In the world of SaaS businesses, managing subscriptions efficiently and having a clear understanding of your financial metrics is crucial for growth and sustainability. Chargebee and Stripe are two powerful platforms that cater to different aspects of subscription management and payment processing, offering solutions to SaaS companies.

Chargebee specializes in subscription management, offering an all-in-one solution for businesses with recurring revenue models. You can set up recurring billing, take advantage of over 29 payment gateways, and manage subscription operations within this tool.

Stripe Billing is primarily a payment gateway with additional features for managing subscriptions such as creating, managing, and charging.

While both platforms offer valuable and distinct functions, integrating Stripe and Chargebee with Baremetrics is the best way to get a complete picture (and full financial insights) into your subscription revenue analytics. In this post, we’ll explain why.

The Limitations of the Stripe and Chargebee Integration

The limitations, however, come into play with detailed financial revenue analytics. Each platform will have its own financial reporting data, and they’ll likely include metrics like total payments made or refunds processed during a set time.

The data, however, can be spread out across different platforms. Stripe has its own data, Chargebee has its own data, and any other third-party platform you use (like the Apple App Store or Shopify Partners) will have its own reporting.

The data exists in silos, making it difficult to get a complete picture of what’s happening across your entire business, and it might not be quite as in-depth as it could be.

Stripe and Chargebee: What's Next?

You’ve integrated Stripe and Chargebee, and Baremetrics can help you take that integration to the next level.

Let’s discuss how our subscription analytics platform can help you dive deep into your financial data and how you can leverage it to optimize your revenue moving forward.

1. Get Unrivaled Financial & Revenue Analytics Tailored to Subscription Businesses

Baremetrics is a subscription- and SaaS-focused revenue analytics platform. We offer 26 unique financial metrics that all are relevant specifically to subscription businesses, including detailed looks into your revenue, churn, and active subscription data.

You can do all of this while building customizable reporting dashboards so you can view all the critical metrics you need to see in one glance.

While Stripe and Chargebee each have their own financial data, neither platform offers the level of insight combined that Baremetrics offers.

This brings us to our next point.

2. See All Financial Data in One Dashboard

When you integrate Chargebee and Stripe with Baremetrics, you gain the significant advantage of using one holistic, comprehensive dashboard that provides all the financial metrics from multiple data sources.

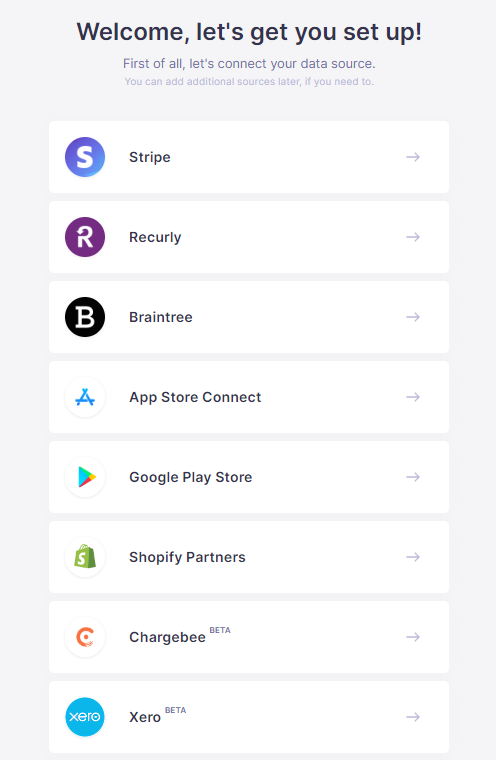

So, even outside of Chargebee and Stripe, you can also integrate other subscription and payment platforms, including Shopify Partners, Xero, Recurly, Braintree, Google Play, and more.

Not only does this prevent a data silo issue (which in turn gives you more accurate and complete information), you can even compare different platforms directly to one another within this single dashboard. You can better assess performance and understand how different platforms are performing and how they impact your bottom line.

If you want to track your revenue or manage your total expenses accurately, it’s important to get a complete picture of what’s happening with your business’s finances across all platforms.

3. Gain Actionable Insights

Baremetrics provides detailed analytics on granular financial KPIs like monthly recurring revenue, churn rates, and average revenue per user. But we also go beyond the actual metrics to provide actionable insights to help you optimize for improved revenue.

Some Baremetrics insights include:

- People insights, which include rich customer histories and personalized segmentation features so you can learn more about your customers and audience segments.

- Cancellation insights, which can help you determine why customers are canceling their subscriptions, calculate revenue lost by cancellations, and offer automated campaigns to re-engage churned customers.

- Trial insights, which can help you identify high-value trials, track active trials, and monitor ending-soon trials for improved conversion rates.

- Revenue forecasting, which offers revenue modeling, forecasting, and scenario planning all in one place.

4. Leverage Automation to Maximize Revenue

Baremetrics offers several automation features designed to help you drive the most revenue possible.

One standout feature is our Recover tool, which relies on a combination of different tools to help you combat failed payments to re-engage customers and prevent churn before it actually happens.

You can automate customizable drip email campaigns, in-app reminders, and paywalls, and use credit card capture forms.

If a user’s saved credit card expires, for example, you can send a prompt letting them know it has expired with a form to update their card information.

How to Integrate Stripe with Baremetrics

If you’re wondering how to get started with Baremetrics’ financial data, the good news is that integrating all your financial data sources has never been easier.

When you first create your account, we’ll ask you to connect your data sources right away. You can start with Stripe, for example, and in just a few clicks, you’ll be connected, and we’ll start importing your data right away.

If you need more assistance, check out our instructions on how to integrate Stripe with Baremetrics.

Final Thoughts

Chargebee and Stripe have created outstanding tools in their niche, and so has Baremetrics. Integrating all three tools together gives you a powerful combination of strong subscription management, a convenient and accessible payment processor, and an accurate and detailed financial reporting analytics tool.

Baremetrics offers truly accurate data that you can rely on. Unlike many tools in the space, we take accuracy seriously. Many tools, for example, will show all subscription profits in your revenue data, even if they’re paused, canceled, or delinquent in payment.

We ensure that the revenue data you’re seeing is accurate and up-to-date, giving you reports you can trust and base decisions on.

Ready to learn more about your subscription revenue and to get accurate data for data-informed decisions? Book your free demo today.