Table of Contents

Customer lifetime value (CLV) is one of the main metrics SaaS companies track to monitor their profitability and growth. CLV is simply the average amount of revenue you can expect to generate from a single customer before they churn.

In this article, I am going to go through what CLV is, how to calculate CLV, why CLV is important, and how to maximize your CLV by tending to your customers following the “retention” part of the AARRR pirate metrics.

Calculate your customer lifetime value

Get deep insights into MRR, churn, LTV and more to grow your business

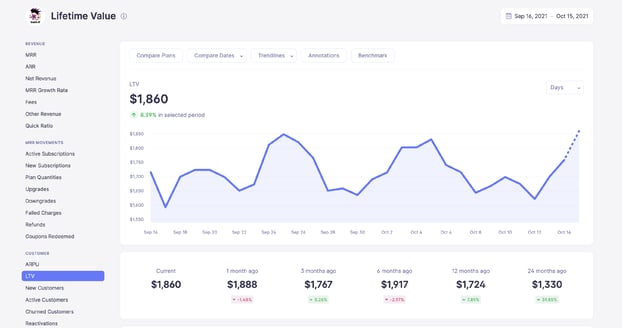

Note that customer lifetime value is alternatively abbreviated as CLV, LTV, and CLTV. I’ll try to stick to CLV here, but Baremetrics generally uses LTV so you might see that in some screenshots.

What is Baremetrics?

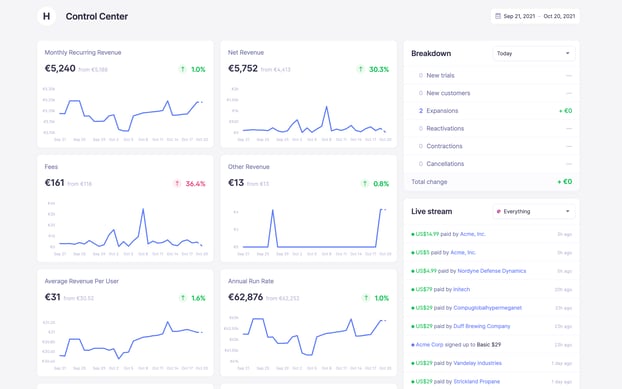

Baremetrics provides an easy-to-read dashboard that gives you all the key metrics for your business, including MRR, ARR, CLV, total customers, and more directly in your Baremetrics dashboard. Just check out this demo account here.

Connect Baremetrics to your payment processor, including Shopify and Stripe, and start seeing all of your revenue in a crystal-clear dashboard. You can even see your customer segmentation, deeper insights about who your customers are, forecast into the future, and use automated tools to recover failed payments.

All of these features collectively help you give personalized care to your customers to maximize the length of their contracts.

Sign up for the Baremetrics free trial and start seeing more into your subscription revenues now.

Just look at the dashboard with all the metrics Baremetrics provides:

This is real data from an Open Startups company!

How do you calculate customer lifetime value?

CLV is simply the average amount of revenue a customer pays you before they churn.

This can be calculated using the average revenue per user (ARPU) and the average customer lifetime as follows:

CLV = ARPU × Customer Lifetime

For example, if your ARPU is $100/month and your average contract length is 12 months, then your CLV would be $100 × 12 = $1,200.

This leads to the question: How do you get to an ARPU of $100 or a contract length of 12 months?

Unfortunately, you can’t know the contract length of a customer until they quit. You also can’t know the average customer lifetime until a significant number of customers churn.

That means that using ARPU and customer lifetime to calculate CLV only works with quite mature companies. When your SaaS company is just starting out, you need to use a different method to calculate your CLV.

As a startup, you can calculate your CLV using customer churn. Customer churn is the percentage of customers that leave your platform in a given month:

Customer Churn = (Churned Customers/Total Customers) × 100%

For example, if you have 500 customers and 25 customers leave your site over the course of a month, then your customer churn is: (25/500) × 100% = 5%.

By dividing your ARPU by customer churn, you can get your CLV:

CLV = ARPU/Customer Churn

If your customers are paying the same amount monthly as above ($100), then your 5% churn gives you a CLV of 100/0.05 = $2,000. Note that in the calculation you should use churn as a decimal not a percentage.

How do you find your customer lifetime value?

I’ve just given you the formulas required to calculate your CLV, but how do you get those numbers? The following is the four-step procedure to figure out your CLV.

1. Determine your MRR

Monthly recurring revenue (MRR) is the average amount you earn in subscription revenue per month. This is probably the single most important growth metric you’ll track.

MRR can change a lot month to month. To get a good baseline of the current month’s MRR, calculate your MRR for the previous couple months and follow the trend to get the best possible representation of the current month’s MRR.

2. Calculate your ARPU

Your ARPU is likely to jump around as customers switch between different tiers, try different add-ons, are charged different amounts of usage or overages, etc.

That’s why it is a handy trick to use your MRR to calculate your ARPU.

All your need to do is divide your MRR by the number of users of your app to get your ARPU:

ARPU = MRR/Total Number of Customers

3. Measure your customer retention

Customer retention is the opposite of customer churn. It is the percentage of customers that stick with your service during the current month. This gives you your churn for calculating CLV.

4. Calculate your customer lifetime value

Simply take your ARPU and divide it by your customer churn to get your CLV.

Use Baremetrics to calculate your customer lifetime value

While this four-step process might sound easy in principle, keeping all of that information accurate and up to date by hand is anything but. Out of date or unreliable data will turn your CLV into just another vanity metric.

That’s why you need a metrics dashboard to do the hard work for you.

Baremetrics monitors subscription revenue for Shopify Partners. Baremetrics can integrate directly with Shopify and pull information about your customers and their behavior into a crystal-clear dashboard.

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, the total number of customers, total expenses, and more.

Sign up for the Baremetrics free trial and start managing your subscription business right.

Baremetrics can even display your customer lifetime value:

Why is customer lifetime value important to your business?

CLV is useful for so many reasons, but let’s look at just a few of them in detail.

Measuring customer lifetime value directly affects your revenue

Keeping track of your CLV helps you determine the specific value of different customers. This way you can provide special customer care to those customers that are the most valuable to your company.

It can also help you determine which products, service plans, etc. are providing the most revenue. If some of your features aren’t being used while others are driving major traffic, then you can change your future development plan to match the tools demanded by the market.

Measuring customer lifetime value boosts customer loyalty and retention

By seeing just how much added value can be generated by increasing the length of time your average customer maintains their contract, you will spend more time and resources on customer care.

The opposite side of this greater emphasis on customer service is that your customers will be more loyal and adoring. Since referrals, testimonials, and positive reviews are key parts of any strong inbound marketing campaign, having customers that truly love your service will increase your long-term profitability.

Measuring customer lifetime value helps you target your ideal customers

The best way to find more customers is to have a well-defined ideal customer profile (ICP).

It is also the best way to ensure a long average customer lifetime because the customers that get the most value out of your service are the ones that will stay signed up the longest.

Measuring customer lifetime value sets the budget for customer acquisition costs (CAC)

CLV is at its most valuable when it is combined with customer acquisition cost (CAC). CAC is the average cost of getting one new paid customer. CLV is often combined with CAC as the CLV to CAC ratio. A CLV to CAC ratio of 3 (which means you earn $3 in CLV for every $1 spent on CAC) is generally considered sustainable.

Your CLV to CAC ratio should improve over time so don’t fret if you aren’t meeting the benchmark to start.

However, if your CLV to CAC ratio doesn’t seem to be improving, then you need to make changes. You need to find a cheaper way to get new customers, increase your prices, or decrease your churn.

Customer lifetime care increases customer lifetime

Customer retention is the most important thing you can work on. That’s because it is way more expensive to find new customers than keep current ones happy—some estimates put it as high as 25 times more expensive!

That’s why you need to identify your customers at risk of churn quickly and focus on them. Baremetrics has a couple of great products to help reduce churn.

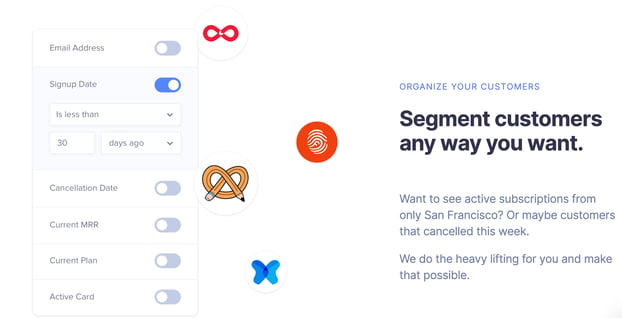

Customer Insights helps you separate out different groups. By filtering for customers similar to those that have churned, you can figure out why and take positive actions to prevent the loss of more customers.

Take a look:

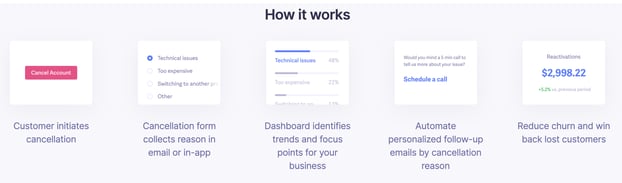

Cancellation Insights helps you understand why a customer has left. This can help you reactivate them in the future as well as prevent similar customers from also leaving.

Take a look:

Summary

CLV is an important metric that is needed for decision making throughout the company. CLV is used to calculate your CAC budget, and its components ARPU and churn are used in many of your growth metrics.

However, CLV is only part of the picture. Without a host of other metrics, it is hard to make optimal decisions. Calculating CLV, along with all of these other metrics, directly on Stripe or Shopify can be difficult.

So, whatever payment processor or CRM you choose, use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data. Integrating this innovative tool can make financial analysis seamless for your SaaS company, and you can start a free trial today.

FAQ's

-

What is Customer Lifetime Value (CLV) and why is it crucial for SaaS companies?

CLV is the average revenue expected from a customer before they churn, crucial for monitoring profitability and growth in SaaS companies. -

How can you calculate Customer Lifetime Value using ARPU and Customer Lifetime?

CLV = ARPU × Customer Lifetime, where ARPU is the average revenue per user. -

How does customer churn affect Customer Lifetime Value?

Higher churn rates decrease CLV, calculated as CLV = ARPU/Customer Churn. -

What are the benefits of connecting Baremetrics to your payment processor for CLV analysis?

It provides a clear dashboard with key metrics including CLV, aiding in revenue analysis and customer segmentation. -

How can Baremetrics help in maximizing the Customer's Lifetime Value?

Through features like customer segmentation and automated tools for recovering failed payments, aiding in personalized customer care to extend contract lengths.