Table of Contents

Sweet baby rabbits it’s been a long time since I’ve written one of these. Four whole months. Way. Too. Long. At any rate, here we are and my how things have changed since our last Inside Baremetrics.

First let’s take a quick, high-level look at what’s happened in the past four months, then I’ll do a full rundown of our insides for the month of November.

Four months of change

I’ll just hit the high points as we covered a lot of ground in these four months.

- MRR increased 38% ($18k to $25k)

- We hired 4 people (making us 6 folks full-time)

- Launched two major features.

- Snagged $500,000 as part of a new Stripe fund.

- Gave everyone Unlimited Team Members.

- Turned one year old.

- Scored our .com for a measly $600

So, there you have it. A quick overview for that big gap in my ability to post monthly updates. Now, on to last month!

Revenue

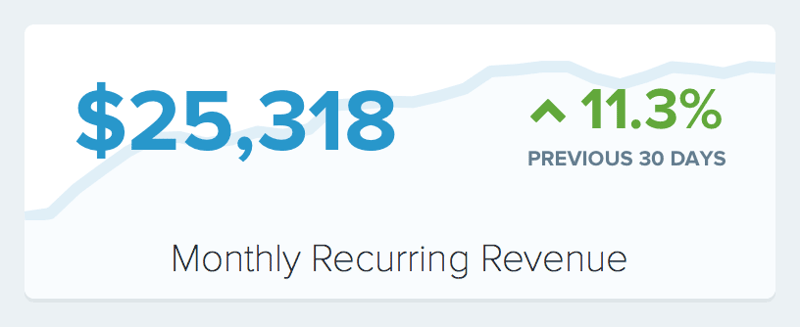

Total revenue for November was $26,200 and recurring revenue was $25,300 (we sold an annual plan in there).

For MRR, that’s an 11% increase over the previous month. My goal is to average 10% MoM growth for at least the next 12 months and that’s roughly what we’ve been averaging the last 3. It’ll be hard to keep that up, but based on what we’ve got in the pipeline, I feel relatively confident in that.

Breaking the $25,000/mo mark also puts our ARR over $300,000 which is a nice feeling.

Customers

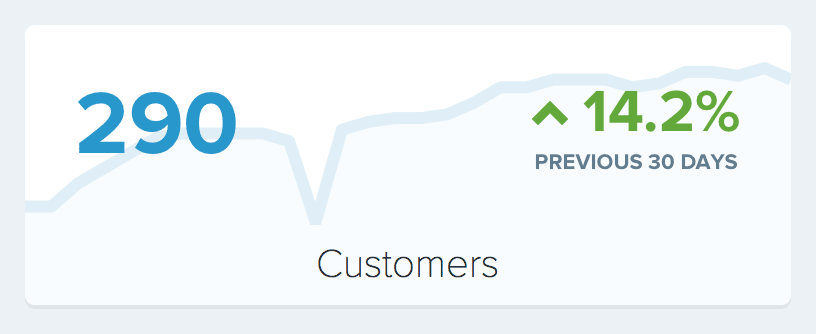

At the end of November we had 290 customers. That’s a 14% increase over the previous month.

We reintroduced our $29/mo plan, which accounts for some of that growth.

Why reintroduce a lower-priced plan? It’s ultimately a long play. The $39 and $29 plans basically had the same churn rates, while the $29 plan tends to bring more new customers. The play here being that having more customers on the $29 plan means greater access to businesses that will eventually become $79/mo customers.

Churn, LTV & ARPU

Churn, LTV and ARPU have basically all stabilized for the past few months.

User churn has been around 5%, putting LTV around $1500, and ARPU has been in the $85-88 range.

Churn is still higher than I’d like, but the fact that it’s not violently rising and falling makes it much easier to methodically focus on lowering.

Future updates

We’re planning on breaking out these “Inside” posts into smaller, more in-depth pieces covering different aspects of the business. I’m hoping we can give a lot more insight in to the areas of the business you actually care about, so stay tuned!

(You can take a look at previous month’s posts here…)