Table of Contents

Key Takeaways:

- Churn reduction is essential to increasing your business’s recurring revenue, overall profit, and growth

- Identifying common reasons customers fail to retain is key to slashing churn rates

- Creating strong customer experiences that start with onboarding and include proactive outreach can improve retention from the beginning of their journey

- Tracking key churn metrics through a thorough churn analysis helps you track key trends and adapt

- Dunning tools like Baremetrics Recover prevents involuntary churn

I spent over a week speaking with different SaaS founders and marketers about how they successfully reduced churn for their businesses.

One founder told me the key to how he was able to achieve 0.1% churn by doing something every SaaS business should be doing, but most don’t.

Another walked me through the onboarding emails he sends to retain 94.7% of his customers.

And one showed me a simple tactic their company used that helped reduce churn from 9% to 7.5% in just a few months.

Those are just a few of the people I talked to. There are plenty of others who were gracious enough to share their “secrets” with me.

Want to know one thing they all had in common?

None of them relied on one-off gimmicks like cutting their pricing by 50%, or hiding their cancellation button. They all used sustainable strategies to reduce churn while also growing their business.

Now, I’m passing along everything I learned from them to you!

In this guide, we’re going to go over six strategies to reduce churn, with real-life examples from SaaS companies that have successfully done it.

Understanding Churn: The Basics

To get you started, here are a few key resources:

- Churn can be defined as resources lost in a given period of time. Our blog post talks more about SaaS churn

- You’ve got user churn and revenue churn, in which customers or revenue churn from your business, respectively

- You can track gross and net revenue churn to more accurate analysis

- You can check out our blog post on how to calculate churn for more information about tracking different types of churn

- It is possible to obtain a negative churn rate, but shooting for a “good” churn rate of 8% or under is outstanding

User Churn vs. Revenue Churn

Most people talking about churn refer to user churn.

User churn is the number of customers you lose in a given timeframe (typically per month or year).

There’s also revenue churn.

Revenue churn is the revenue you lose in a given time frame due to downgrades or cancellations.

The reason why it’s such a vital metric is that it has a greater effect on your business. If you look at just user churn, you’re ignoring how much revenue you’re losing with those churned users.

For example, a churned user on a $50/mo plan isn’t nearly as bad as a churned user on a $500/mo plan.

Just looking at user churn would gloss over the fact that you lost a major customer. Revenue churn effectively weights your user churn to be a more accurate representation of your business's performance.

Signs That You Have a Churn Problem

If you run a SaaS or subscription business, you’re in a constant battle to reduce churn as much as possible because it improves your monthly recurring revenue (MRR) and creates more sustainable growth.

But you should also remember that having a little churn is okay—emphasis on little.

It’s generally accepted that anywhere between 5-7% is a “healthy” monthly churn rate.

Within that range, your business is at a point where you’re losing some customers, but not enough that you can’t balance things out by acquiring new or expanding your current customers through offering upgrades, add-ons, etc.

If you’re curious about how your churn stacks up with similar companies, our Open Benchmarks show you average churn rates based on average revenue per user.

So, when should you start worrying?

Should you run around with your arms flailing in terror if your churn rate hits 9%?

Not necessarily. Every business is different, and what’s considered “high” for one might be ok for another.

There are some red flags you should look out for, though. Here are a few signs that you might have a churn problem:

- Your churn is outpacing new customers: This one is pretty obvious, but it's a potential red flag if you regularly lose more customers than you’re acquiring, particularly if you’re not upselling your current customers.

- LTV is shrinking: In most cases, The longer your customers stay with you, the higher the lifetime value (LTV) of your average customer should be. So, if customers are constantly churning, you’ll likely see a downward trend in your LTV.

- Your churn rate is above 10%: As I mentioned earlier, 5-7% is considered an average churn rate. But when you start getting into double digits, it’s usually a sign that something in your process isn’t working. It could be the way you’re acquiring customers, your onboarding, or another part of your business. But if over 10% of your customers are canceling, it makes it difficult to grow long-term.

- More downgrades than upgrades: If you offer different plans or add-ons for your product, you want to have more customers upgrading than downgrading. Otherwise, you’re likely to deal with a revenue churn problem.

Those are just a few signs of a churn problem. But chances are, if your churn is getting to uncomfortable levels, you’ll feel it all across your business.

Even if you don’t have a high churn rate, there’s no reason why you shouldn’t aim to get it lower if possible. And if you’re unsure where to start, we’ve got you covered!

6 Churn Reduction Strategies for SaaS Businesses

Now that you have some background info let’s talk about how to reduce your churn.

Unlike other articles you might’ve read about how to reduce churn, we’re going to stray away from tactics like “sell annual plans” or “make it harder to cancel.”

Sure, those things might reduce your churn, but they won’t solve the root issue of why customers are churning.

It’s like using duct tape to seal a leaky pipe. It’ll temporarily stop the leak, but eventually, you’ll need to change out that part of the pipe, or it’ll start leaking again.

We’re going for the permanent fix.

Here are six strategies for reducing churn over the long term.

1. Identify Why Customers Cancel

To reduce churn, the first thing you need to do is find out why customers are canceling. The easiest way to do that is to just ask! Your cancellation flow should include a short survey where you ask customers why they’re canceling.

You can use our Cancellation Insights to create a form like this and track the responses. The best part is we’ll even show you how much money you lose due to each cancellation reason.

Once you start getting responses, the next step is to look at the data and make changes to prevent it from happening again. Prioritize them by which cancellation reasons are costing you the most money.

That’s exactly what Usersnap did in order to figure out why so many customers were canceling after only a month or two.

They added a cancellation reason field to their unsubscribe page and started to monitor the responses. A common issue started popping up.

Based on the feedback, they launched a new product line that allowed customers to keep their accounts for more than one-time projects.

Asking customers why they’re canceling is one of the easiest ways to get valuable insights that can save your business.

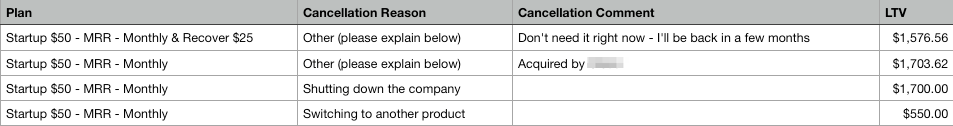

Make sure you customize the cancellation reasons in your survey based on your product. For instance, at Baremetrics, we allow people to choose from these options:

- Too expensive

- Switching to another product

- Shutting down the company

- Technical issues

- Not sure how to use the data & tools

- Missing features I need

- Other

As you can see, a couple of options are very specific to our product/industry. Since our customers are largely startups, the “Shutting down the company” option makes sense because if they no longer have a company, there’s no need for our product.

You should also always include an “Other” field for people who don’t fall into any of the listed reasons. The more info you can get on why customers churn, the better.

Pat Walls, founder of Starter Story and other ventures, has a solution to increase the odds of getting responses.

You would be crazy not to do everything you can to find out why customers are canceling. That kind of knowledge is power, and you need this feedback to build a great product.

But how do we find out why customers cancel? The hardest thing is getting an answer at all. Then, the next hardest thing is getting a good answer. Sure, you can email them, call them, tweet them, whatever.

But here’s the secret to finding out why they are canceling: build a relationship with them before they cancel.

If you can develop even the smallest personal relationship (even just a simple personalized email after signup, a friendly support conversation, etc), then the customer will be more inclined to share with you why they’re canceling when they cancel because they see you as a human.

One way I build that personal relationship is to send every new trial a one-minute personalized video in which I introduce myself and welcome them to the trial.

I learned this from Davis Baer, the founder of OneUp.

Of course, you still have to ask why they canceled, though—I just send a simple email asking why:

The punchline here is that you must find out why customers cancel. And if the first time you interact with a customer is when they’re canceling, that’s probably part of the problem.

2. Create a Superstar Onboarding Process

When customers sign up for your product, do you just leave them to set everything up independently? Or do you proactively guide them to make sure they’re getting the most from their subscription?

According to data from Wyzowl, most customers aren’t satisfied with how businesses onboard them.

You need to avoid having customers sign up, trying your product once or twice, then never logging back in again because they aren’t sure what to do next.

So, where do you start?

First, make sure you have the right tools in place.

Pulkit Agarawal, the CEO of Chameleon, shared their onboarding stack with me. They divide their toolset into five categories and recommend other companies do the same:

| Tool category | What they use | How to use it |

|---|---|---|

| User data | Clearbit | Find out who your customers are so you can tailor the onboarding experience to them individually. |

| Product tour | Chameleon | Give your customers the best first experience of the product possible by guiding them through it. |

| Communications | Intercom | Keep customers informed throughout the process with a clear line of communication. |

| Support | ReadMe | Help your customers learn more about how to use your product. |

| Analytics | Mixpanel | Find out what works and doesn’t for your customers. |

You also need to realize that having all the tools in the world will not help much if your onboarding process is garbage.

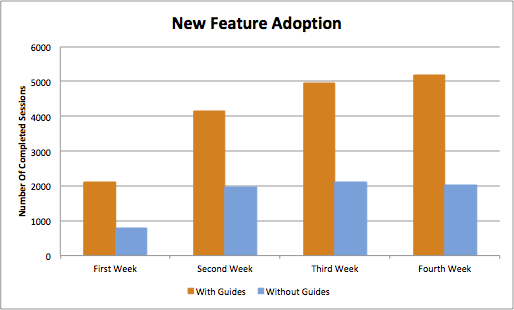

MobileAction is an app store optimization tool. When people sign up and log into the dashboard for the first time, Mobile Action provides a guided tour with UserGuiding to walk them through the product.

This seemingly small step made a big impact. They were able to:

- Decrease their time to adapt by 32%

- Increase their breadth of adoption by 38%

- Increase their net promoter score by 26%

- Improve their new feature adoption

All of these metrics directly relate to churn. When users adapt your product quicker, try new features, and are more engaged, they’re less likely to churn. Focus on getting your customers to use your product actively, and you could see a drop in churn like MobileAction.

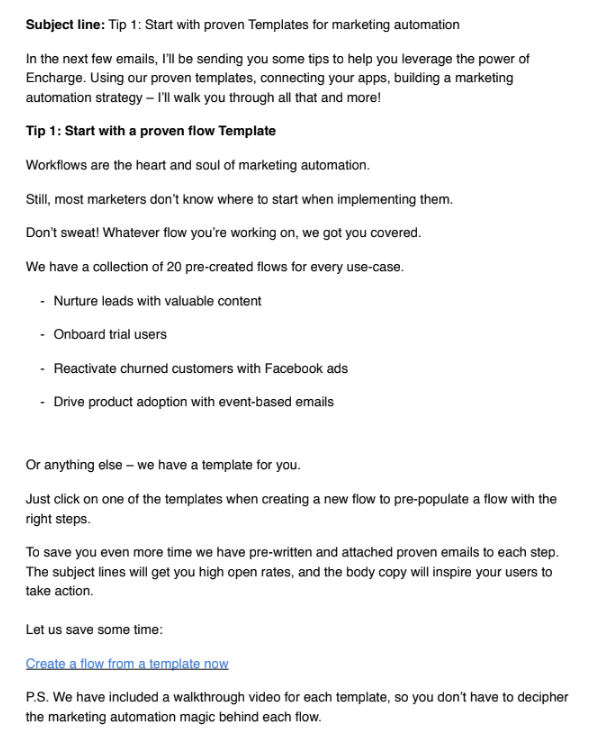

Another company that created a magnetic onboarding process to reduce churn is Encharge. Their co-founder, Kalo Yankulov, was kind enough to break down their strategy for me.

At Encharge, we have a very low churn rate because of our high-touch onboarding process. If a user churns, it usually happens within the first month of their subscription. A churned customer means we haven’t managed to onboard them effectively, or the account is simply not a fit for Encharge.

This pattern in churn, together with our tool's complexity, is why we focus heavily on our onboarding process.

We put trial users into two parallel buckets or swim lanes:

- Automated email onboarding sequence

- A sales-driven cadence

We use our product to orchestrate these onboarding activities/emails and get a full picture of the onboarding process of the person.

Every trial user gets in the first bucket and receives a series of time-based and trigger-based emails. We want to get our trial users to follow the shortest path to their desired outcome. An active user in our platform is someone who has imported email contacts, created at least one email and activated an email flow.

In our onboarding emails, we strictly follow what we call the “simple email formula” that each email should have one goal, one desired outcome for the user, and just one call to action.

In the email example below, we nudge people to create their first automation flow by providing the quickest shortcut—using templates in our platform.

On top of this, we use a CRM to execute and track sales activities that we follow for the hot leads. The sales process is broken into three calls and supported by multiple email/social media follow-ups.

The first call is a quick, 15-minute qualification call that we use to figure out if the lead fits our customer persona and if our software is going to help them.

The next call is an extended 45-minute marketing automation strategy/email review call, where we try to provide as much business value as possible. This is more of an advisory call than a product demo call.

The last call is an onboarding call where we discuss technical details, demonstrate specific product features, and answer specific questions.

There are no growth hacks here but this personal, consultative-driven onboarding approach helps eliminate our churn with high-value customers.

Another company that takes a similar approach is Promoly. Their co-founder, Pete Callaghan, gave me a deep dive into how they use automated emails to improve retention for people in trials.

I’m explicitly measuring people logging into the app and reaching certain milestones within their trial stage. That’s my main focus right now.

When someone starts a trial, I have an onboarding sequence that nudges them in the right direction of completing various goals.

I send a series of emails (using Autopilot) that are triggered by customer behavior as well as nicely timed emails on a sequence. The trick is to get the user to take action from that email.

Within the body of the email, I tell them how to do something within the app and provide a link to take them to the appropriate app section.

I believe delivering an email in the right moment of their trial helps build trust, guidance and increases conversion. Ultimately, it creates a conversation between the user and me, which is crucial if you want them to stick around for a long time.

For example, the first-ever email sent has a 63% open rate and a 19.6% CTR. In this email, I welcome and tell them how to create a campaign within our app. I keep it very simple and don’t confuse the message.

Here’s the copy:

“Let’s get you up and running: You’ll need music, artwork and a press blurb to start sending promo campaigns. Click the button below to head to your campaign dash. From there, create a new promo. When you’ve done that I’ll be in touch.”

Under the copy, I have a blue button that links directly to their dashboard (our app). As you can see, I give them action and then say I’ll be in touch when they complete the task.

When they’ve completed their task, I deliver another email triggered by our API. The API feeds our email marketing platform, which I can then trigger user-specific emails when needed.

This is a great example when I was talking about delivering an email at the right moment. The first email gives them a goal; our API tells us when they complete it, and I deliver another email with the next target. This email, in particular, gets a 66.7% open rate.

Another email I want to talk about is one that asks the trial user a simple question. This email gets a 67% open rate and a 12% reply rate. It’s delivered 5 hours after signup.

Promoly and Encharge are proactive about reaching out to leads and customers once they’ve signed up. They even gamify the onboarding experience by giving users “tasks” to complete so they aren’t just left to fend for themselves.

3. Build Customer Loyalty

We all know that one person who is loyal to a specific brand.

They’re dead set on only buying from specific brands because the companies have built strong customer relationships.

Customer loyalty isn’t limited to huge international brands that sell physical products. Plenty of smaller brands (including SaaS companies) have die-hard customers who are loyal to them.

For instance, one of my personal favorite tools, Ahrefs has an incredibly loyal customer base.

The popular e-commerce software Shopify is another SaaS company that has built a loyal customer base, judging by this tweet.

One of the biggest differences between a brand loyalist and someone who likes your product is that customer loyalty is tied to your brand, not just your products.

Someone who just enjoys your product might leave if another company releases a similar product at a lower price. Their main concern is the utility of the product.

On the other hand, a brand loyalist likes your product AND your company. They consume your content, attend events, brag about you on social media, and send referrals.

Most importantly, they’re less likely to churn.

The million-dollar question is, how do you build customer loyalty?

Here are a few tips and examples from SaaS brands that use customer loyalty to reduce churn.

Be Open and Transparent

As an open startup, transparency is something that’s built in the fabric of our company at Baremetrics. This level of transparency builds trust in a world where 55% of customers now trust companies less than they used to.

While that’s one way we’re transparent, it’s not the only way to do it. For instance, Airfocus openly shares their product roadmap so customers can see what new features are on the horizon.

Customers can vote for the features they’re most excited about, which helps Airfocus prioritize what to work on next.

Making their product roadmap public helped drop their churn by three percentage points, according to their co-founder, Malte Scholz. Here are his insights into why having a public product roadmap has helped reduce their churn:

"A lot of times, people will sign up for your product not only because of your current offer, but because of what you have planned for the future. If they commit to a product, they want to do it long term, and they want to ensure that you will give them everything they need in the future. A product roadmap is one of the best ways to convince people to stay with you."

- Malte Scholz Co-founder @ Airfocus

If you’re considering doing something similar, Scholz recommends keeping your roadmap 2-3 months out and sharing as much detail as possible.

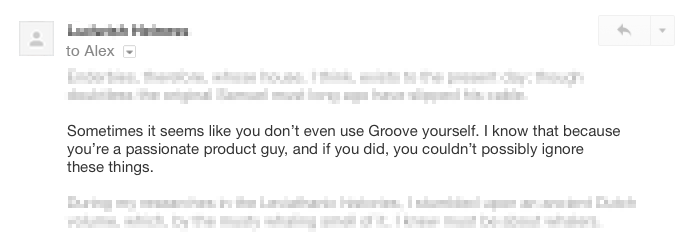

Groove is another great example of honesty and transparency. I won’t dive into the whole story, because their founder already did here. But essentially, the company faced some real growth challenges with infrastructure, design, team structure and even customers being vocal about not loving the product anymore.

While they could’ve ignored the feedback they were getting and wrote it off as customers just not being a great fit.

Their founder, Alex Turnbull, was honest with himself, the company and their customers.

He decided to start from scratch.

They spent over a year (and more than $1,000,000) rebuilding all the work they did in the previous five years.

After the relaunch, things seem to be trending in the right direction, and customers have given them some positive feedback.

Turns out our parents were right all those years when we were kids—honesty really is the best policy.

Celebrate Your Customers

Customers constantly show their appreciation for the companies they love. But a lot of times, it doesn’t get reciprocated, and that could be part of the reason you’re experiencing churn problems.

The good news is that celebrating customer wins is easy to do.

First, you need to identify the customers you’re going to celebrate. If you have hundreds or thousands of customers, it might seem overwhelming to dig through them all and decide where to start. Here are a couple of ways to make it easy.

Option 1: Send Out a Survey

One way we’ve started to celebrate our customers is by featuring them in our content.

I recently sent out a survey to our email list (I used Typeform) to see if anyone would be interested in being featured on our website. One of the questions I asked was, “Are you a Baremetrics customer?”

This allowed me to get a list of our customers who are interested in appearing in our content. We even had some people who were specifically interested in talking about how they use our product!

This is a win-win situation. We get to expose our customers to our audience and send them some referral traffic. In return, we get content to publish on our site.

The survey we sent out was specifically for customers interested in being featured on our website, but you can use this tactic in other ways. It all depends on the questions you ask.

Option 2: Look For Your Highest Value Customers

If you’d rather be more selective about which customers you highlight, another option is to start with your highest-value customers.

These might be customers who have been with you for a long time, the ones who pay you the most, or even those who have sent you the most referrals (if you’re tracking that).

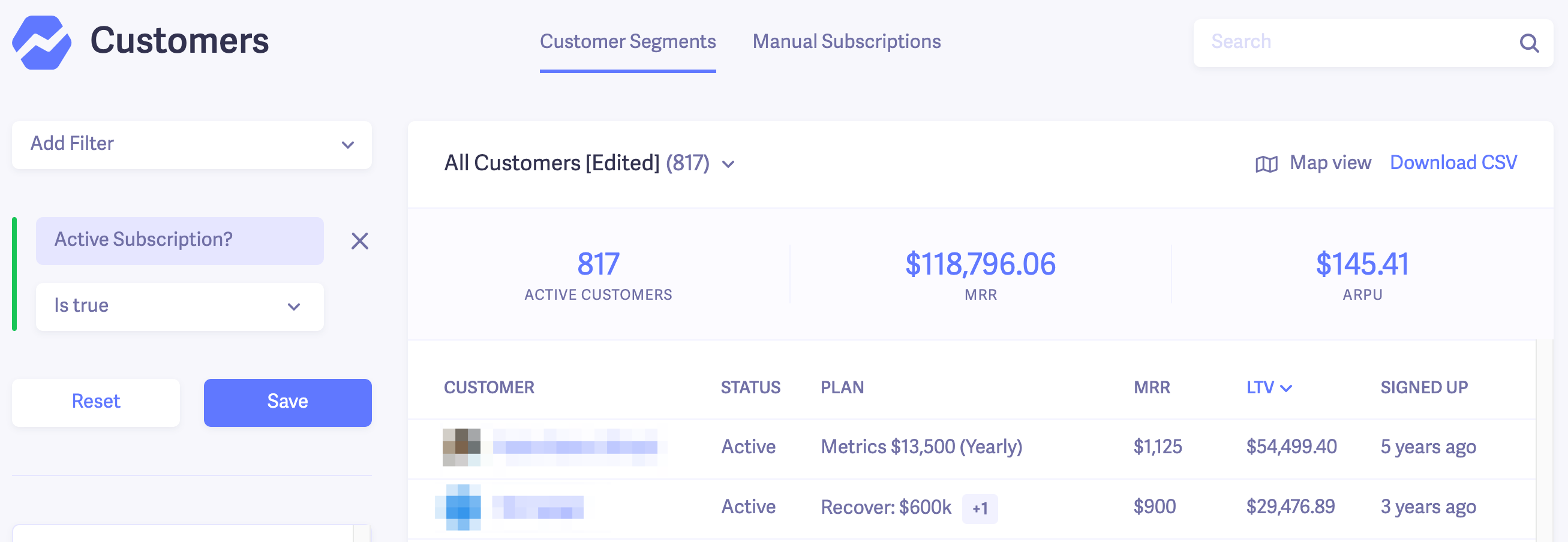

For SaaS companies, you can do this easily in Baremetrics. Just head over to the Customers section. Make sure you’re only showing your active customers.

Then, sort your list by MRR, LTV, or Signed-up date to prioritize who to contact first.

Once you’ve identified the customers you want to highlight, the next step is deciding how to celebrate them.

Here are some ideas to get you started.

- Highlight customers on social media, including featuring their work on your social media

- Sharing customer successes on Twitter or LinkedIn

- Sending customers “thank you” emails after their customers have been with you for six months or a year

- Allowing customers to tell their stories on your blog or newsletter

Whatever route you choose, celebrating your customers makes them feel appreciated and more loyal to your brand. And those customers are less likely to churn.

4. Analyzing Churn By Customer Segments

One of the biggest challenges with reducing your churn is figuring out where to start.

Let’s say your churn rate is at 11%. Trying to reduce that entire number might seem overwhelming. Instead, as a first step, figure out where that 11% is coming from.

Is it spread across customers from each plan you offer?

Do you have any cancellations for your lowest price tier while your enterprise customers stay with you long-term?

Or maybe customers who signed up with a coupon are churning more than those who paid full price.

In order to make sense of it all, look at your churn by customer segments or cohorts.

Since most SaaS companies have multiple pricing plans, that’s usually a good place to start. I’ll walk you through how to analyze your churn by customer segments in Baremetrics.

Let’s stick with segmenting churn by pricing plan first.

Just head over to the Metrics section and choose User Churn.

If you scroll down on this dashboard, you’ll see a section that breaks out your churn by plan. We show you the churn rate for each plan and the average time to churn.

You can sort from highest to lowest churn to see which plans are most canceled. From there, you can start to plan on how to reduce it.

For instance, maybe most of your churn comes from your highest-priced plan, but your low—and mid-tier plans have relatively low churn. This could be a sign that you’re not providing enough value at that top-tier plan to justify the price.

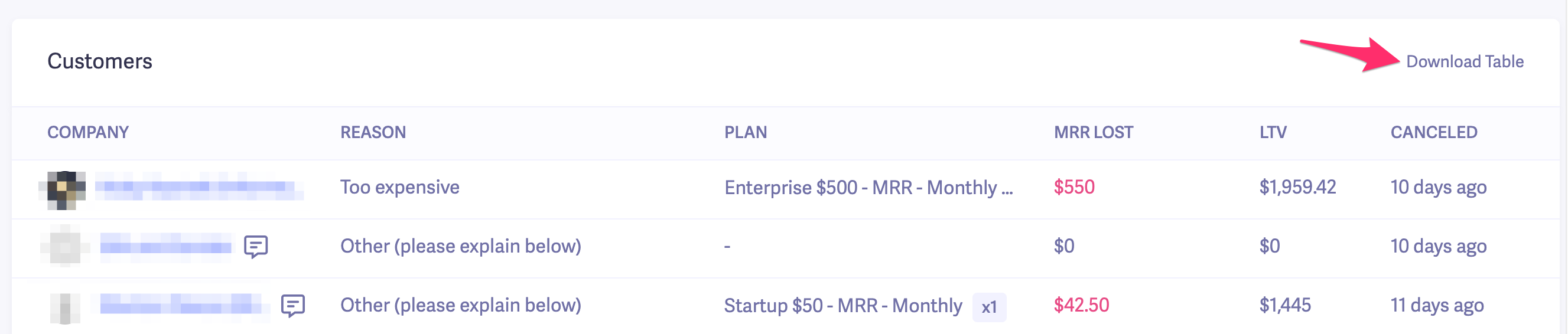

Next, look at the cancellation reason for your highest churning plans. To do that, you’ll need our Cancellation Insights. There, you’ll be able to download a table with all of your cancellations for whatever date range you choose.

Once you download the table, you can sort it by plan level and see why people canceled, including comments.

Using Baremetrics for Customer Segmentation

Following those steps should give you some good insights. But what if you want to segment your customers differently than by price?

Maybe you want to see which countries have the most churn. Or compare the churn rate of customers who came from Instagram vs. Google Ads. You can use our segmentation options to break out your customers based on any criteria you need.

First, you need to set up some segments.

In the Customers area, click “Add Filter” on the left side, and you can scroll through all the available attributes.

We give you some default filters you can apply, like:

- Signup date

- Country

- MRR

- Conversion Date

- Industry

- Cancellation date

- A bunch of others

You can also use Augmentation to bring in data from external sources like your marketing automation software or your CRM. And if you use Intercom, you can use our integration to create filters based on NPS scores, sales rep, acquisition channel or other customer data.

Add any filters you like. Again, as a basic step, I’d recommend creating segments for your different plan levels. So add a Plan filter, and select one of your plans.

Then hit Save and give it a name.

Repeat the process for each plan level you offer. Now that your segments are saved, the next step is to find each segment's churn.

So head over to your metrics, then User Churn.

Then, choose the segments you want to compare. For instance, I could compare churn for customers who signed up in 2019 vs. those who signed up in 2018.

Check out our blog post for more on how to analyze churn.

5. Making Product Usage a Routine

Contrary to popular belief, customers who send complaints or submit a bunch of support tickets aren’t always the ones you need to be concerned about. The people who are really at risk of canceling are the ones you don’t hear from.

Customer complaints are a sign of two things:

- They’re actively using your product

- They want you to improve the product so that they can keep using it

That gives you something to work with. But it's a red flag when a customer isn’t logging in at all.

People sign up for your product because they just discovered it and are excited about it. Then, after a while, they use it less and less.

Step one is ensuring you have a tool to track user behavior in your product. There are several options. At Baremetrics, we use Mixpanel.

From there, just start monitoring user behavior and watch for inactivity. You can even set up notifications in Mixpanel when customers reach a certain period of inactivity.

What’s considered “inactive” will vary depending on the nature of your product.

For instance, with a social media management tool like Hootsuite, customers should probably be logging in at least a few days per week, if not daily to monitor incoming messages and to publish content. But with a resume building tool, users probably aren’t expected to login as frequently.

Once customers reach the threshold you define, use email to push them back into your app. You can gamify it by creating triggers asking customers to complete a certain activity after they’ve been inactive for a while (like the Promoly example we reviewed in strategy #2).

Or, you can just send regular reminders to push customers back into your tool. For instance, Copper sends weekly updates for new sales opportunities and nudges you to login with the question “Have anything new to add to your pipeline?”

When customers are inactive, you need to be proactive about engaging with them.

Sometimes, inactive customers don’t dislike your product; they just get busy or forget. It’s your job to tap them on the shoulder and remind them how to get more value from it.

6. Listen To Your Customers

You need to listen and act on customer feedback when they give it. Customers appreciate it (check out the example from Drift below), but it also can go a long way in improving product performance.

Listening to your customers (and acting on their feedback) directly impacts churn.

I talked to Stas Kulesh, the founder of a nifty tool for Slack called Karma, and he clued me in on how they got their churn all the way down to 0.1%!

"We tend to spend an insane amount of time talking to the customers. In some cases, we manage to implement features in less than 24 hours.

On average, our NPS score is well above 75 and more than 30% of new customers come through the word-of-mouth recommendations."- Stas Kulesh Founder @ Karma

Getting feedback isn’t always easy, though.

How to Collect Customer Feedback

Some companies' problems stem from feedback from all over the place (social media, support desk, personal conversations, etc.), making it tough to keep track of.

As a first step, create a process for gathering customer feedback and product feature requests. At Baremetrics, we use Clubhouse and mark any feature requests as “Feature”.

We also use Slack to talk through feedback and requests from customers. It works great for us, but it’s not the only way.

Here’s another real-life example of how one company reduced churn by listening to their customers.

Dmytro Okunyev, founder of Chanty, gave me some insights into how they were able to reduce their churn by listening to customer feedback.

"We decreased our churn with one simple act—thoughtful listening.

We have quite a few requests for features and product updates, just like most of our competitors. However, we jot down each feature request and once we start working on it, we email the people that requested it.

For example, we recently rolled out threads as a way to communicate in chats, and we messaged each person that requested the feature as we started working on it.

We got in touch once again when we finished and launched the feature. That way, we’ve constantly stayed in touch with people that wanted something more from our product.

It didn’t cost us anything but a few emails sent every day. As a result, our churn decreased from 9% to 7.5% in just a few short months."

- Dmytro Okunyev Founder @ Chanty

7. Recover failed payments

Have you ever wondered how much money you lose when your customers' credit card payments don’t go through?

We found that, on average, SaaS and subscription companies lose about 9% of their MRR due to failed payments.

And if you’re sitting around waiting for your customer to realize their payment didn’t go through, you might as well kiss that revenue goodbye.

Typically, one of two things happens when your customer’s payment fails:

- They eventually realize it and make their payment

- They go ghost and you lose out on the money (hello churn)

Even if the customer does update their payment info later on, you’re still missing out on revenue.

Our very own Head of Growth, Cory Haines, gave some good insights into why it pays to be proactive with failed payments.

"By default, most systems automatically cancel a customer (or consider them canceled) after 30 days of non-payment.

Some founders are averse to a dunning solution because they assume that “some customers end up coming back anyways.”This is naive thinking because those customers are still churning out. Plus, they may not come back for a while so you’re losing out on revenue in the meantime."

- Corey Haines Head of Growth @ Baremetrics

This eats into your customer LTV. It’s always better to try to recover a customer as quickly as possible so they never even enter the churn equation.

Could you imagine manually checking your payments each month and following up with everyone whose card didn’t go through? Nobody has time for all that. So start by automating the process with a dunning tool like Recover.

Preventing Missed Payments With Recover

With Recover, you can set up in-app reminders and paywalls that’ll pop up for customers whose payments didn’t go through or are up for renewal. Here’s an example of what ours looks like:

You can also set up an automated email sequence to send to customers until payment is collected. To prevent failed charges from happening, you can also send emails before credit card expirations and annual renewals.

And don't forget follow-up emails!

The first email has the highest recovery rate, but the follow-up emails have helped us recover tens of thousands of MRR we might’ve lost.

With Recover, you also get data and insights into how much MRR you’ve saved, why payments fail, and other helpful information.

But enough bragging about our product! (I highly recommend checking it out, though)

Once you set up your dunning tool, decide what frequency you want to email customers whose payments have failed. Here’s what our sequence looks like:

| # of Days Delinquent | |

|---|---|

| 0 |

Hi {Customer.Name}! We’ve been unable to process your payment for {Company.Name} using your card ending with ####. Can you please take a moment to update your payment information on our site? |

| 3 | Hi {Customer.Name}! We've still been unable to process your payment for {Company.Name} using your card ending with {Customer.Last4}. Can you please take a moment to update your payment information on our site? |

| 7 |

Hi {Customer.FirstName}! We’ve still been unable to process your payment for {Company.Name} using your card ending with ####. Can you please take a moment to update your payment information on our site? |

| 15 |

Hi {Customer.FirstName}! We’ve still been unable to process your payment for {Company.Name} using your card ending with ####. Can you please take a moment to update your payment information on our site? |

| 20 |

Hi {Customer.FirstName}! I noticed the payment info on file is still failing. Can I help you get it updated?You can update it here: [link] |

| 30 |

Hi {Customer.FirstName}! We’re still unable to process your payment using your card ending with {Customer.Last4}.For your account to stay active, we need you to update your payment info right away. You can update it here: [link] |

It’s usually best to keep these emails short and sweet. The goal is to let customers know their payment failed and get them to update the information. It’s not the time to lecture them about financial responsibility.

Goodbye Churn, Hello MRR

There you have it—six proven strategies for reducing churn. We went over a lot of information here, and I want to make sure you actually take action and don’t get stuck in analysis paralysis.

So here’s a quick breakdown of the top three steps you should take right now to get started:

- If you don’t have reliable data around your churn (what’s your churn rate, which customer segments are churning the most, why customers are canceling, etc.) sign up for a Baremetrics account ASAP. Otherwise, you’re not making informed decisions—you’re just guessing.

- If you don’t currently have an onboarding process in place, start writing out a series of emails outlining the steps customers should take when they first sign up for your product. If you're unsure where to start, refer back to the Encharge, Pigeon, or Promoly strategies above.

- Create a feedback loop so you can learn more about what your customers want from your product. Then, act on their feedback and follow up with them, just like Chanty did to reduce their churn from 9% to 7.5%.

Take those three simple steps today, and you’ll be in a much better position than you’re in right now.

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!"